Is Mithril Invested in China? A Deep Dive into Peter Thiel’s Venture Capital Firm

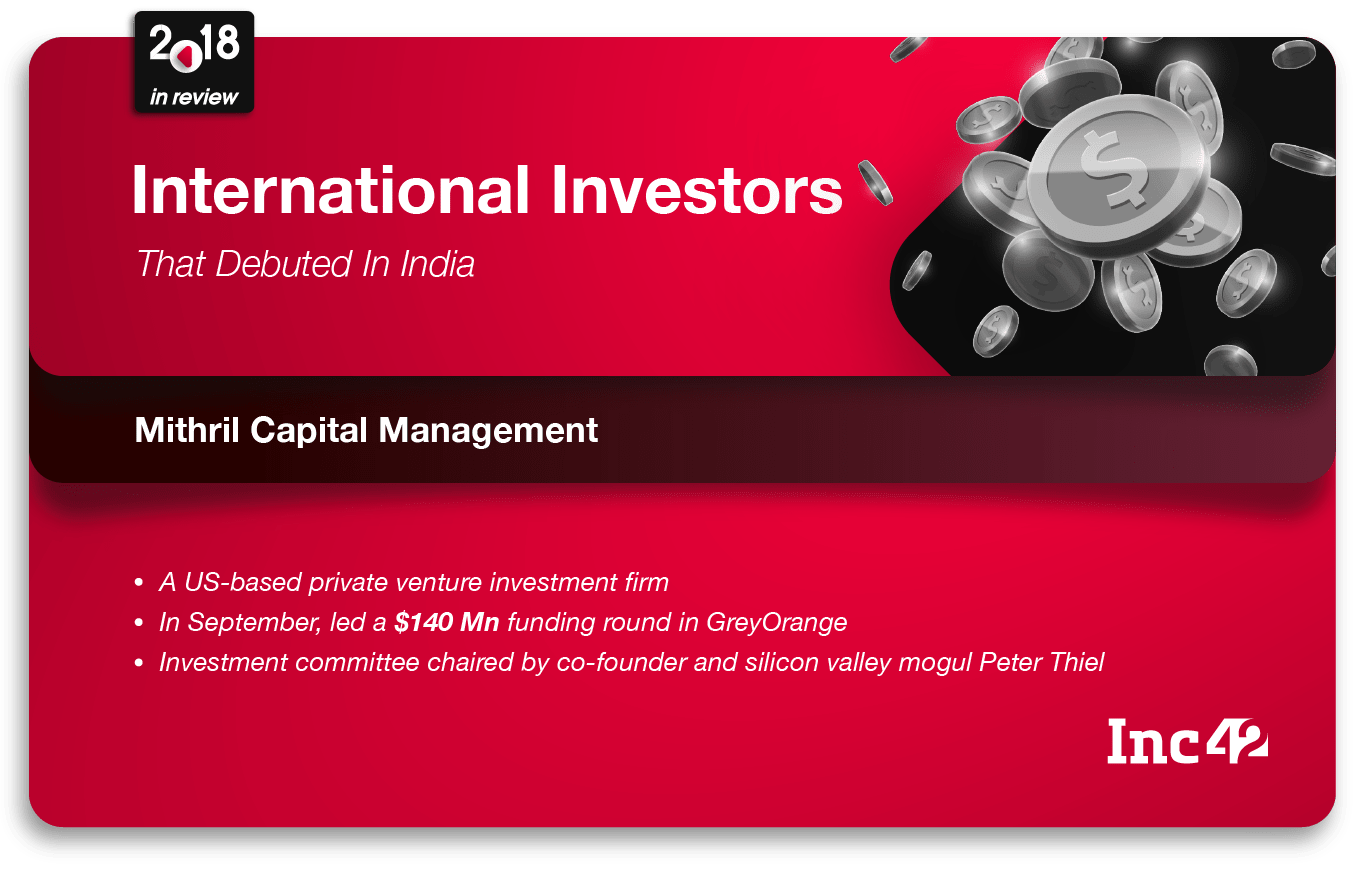

Mithril Capital, co-founded by Peter Thiel and Ajay Pathak, is a prominent venture capital firm known for its contrarian investment approach and focus on technology companies with the potential to reshape industries. A key question often arises regarding their investment strategy: Does Mithril invest in China? Understanding Mithril’s approach to global markets, particularly China, requires examining their public statements, investment portfolio, and the broader geopolitical context. This exploration reveals a complex picture, highlighting both the opportunities and challenges that China presents for venture capital firms like Mithril.

Mithril’s Global Investment Philosophy

Mithril’s investment philosophy centers around identifying and nurturing “category-defining” companies. They look for businesses with the potential to achieve significant scale and create lasting impact. This approach is inherently global, seeking out promising ventures regardless of geographical location. While the firm is headquartered in San Francisco, their portfolio reflects a commitment to exploring opportunities beyond Silicon Valley. They have invested in companies across various sectors, including software, biotechnology, and fintech, demonstrating a willingness to look beyond traditional investment hubs.

The Allure and Complexity of the Chinese Market

China represents a massive and rapidly evolving market, making it a tempting target for venture capitalists. The country boasts a large population, a burgeoning middle class, and a dynamic tech scene. Chinese companies have emerged as global leaders in areas like e-commerce, mobile payments, and artificial intelligence. The potential for high returns in the Chinese market is undeniable.

However, investing in China also presents significant challenges. The regulatory environment is complex and can be unpredictable. Concerns about intellectual property protection and data security are also prevalent. Furthermore, the Chinese government’s increasing emphasis on national security and data sovereignty has added another layer of complexity for foreign investors.

Mithril’s Public Statements and Investment Portfolio

Examining Mithril’s public statements and investment portfolio provides some clues about their approach to China, although they haven’t explicitly outlined a detailed China-specific strategy. While Mithril has invested in companies with a global presence, including some with operations in China, there is limited evidence of substantial direct investments in Chinese companies. This suggests a cautious approach to the Chinese market.

It’s important to distinguish between a company having a presence or operations in China and being a Chinese company. Many multinational corporations operate in China, and investments in these companies may indirectly expose Mithril to the Chinese market. However, this is different from directly investing in a company headquartered and primarily operating within China.

The Geopolitical Context and its Influence

The current geopolitical climate plays a significant role in shaping investment decisions related to China. The increasing competition between the United States and China, particularly in the technology sector, has created new risks and uncertainties for investors. Governments in both countries have implemented policies aimed at restricting foreign investment in certain sectors, particularly those deemed strategic or sensitive.

This geopolitical context likely influences Mithril’s investment strategy. The firm, with its strong ties to the US, may be wary of potential political backlash or regulatory hurdles associated with significant investments in Chinese companies. Furthermore, concerns about technology transfer and intellectual property theft may also be a factor.

The Role of Peter Thiel’s Views on China

Peter Thiel, a prominent figure in Silicon Valley and a vocal critic of China’s policies, plays a significant role in shaping Mithril’s overall investment direction. Thiel has expressed concerns about China’s rise and its implications for the global balance of power. His views on China likely influence Mithril’s investment decisions, potentially leading to a more cautious approach to the Chinese market.

Thiel’s perspective on China is multifaceted and includes concerns about intellectual property theft, forced technology transfer, and the Chinese government’s increasing control over the private sector. These concerns are likely shared by other investors and contribute to a more cautious approach to investing in Chinese companies.

Alternative Investment Strategies and Indirect Exposure

Even without directly investing in Chinese companies, Mithril may still gain indirect exposure to the Chinese market through investments in multinational companies that operate in China. Many of the companies in Mithril’s portfolio likely have business dealings in China, either through sales, manufacturing, or supply chains. This indirect exposure allows Mithril to benefit from the growth of the Chinese market without taking on the full risks associated with direct investments in Chinese companies.

Furthermore, Mithril may explore alternative investment strategies, such as investing in companies that serve the Chinese market from outside of China or investing in technologies that are relevant to the Chinese market but developed elsewhere. These strategies allow Mithril to participate in the growth of the Chinese market while mitigating some of the risks associated with direct investments.

The Future of Mithril’s China Strategy

The question of Mithril’s investment strategy in China remains open. While current evidence suggests a cautious approach, the situation could evolve. Changes in the geopolitical climate, regulatory environment, or the emergence of compelling investment opportunities could lead Mithril to reconsider its approach.

It’s also possible that Mithril is pursuing a more nuanced strategy in China, perhaps focusing on specific sectors or types of investments. They may be investing in Chinese companies through more indirect channels, such as venture funds or partnerships with local investors. These types of investments may not be as readily apparent in their public portfolio.

Conclusion: A Complex and Evolving Picture

In conclusion, determining the extent of Mithril’s investments in China requires a careful analysis of their public statements, investment portfolio, and the broader geopolitical context. While there is limited evidence of substantial direct investments in Chinese companies, Mithril may still gain indirect exposure to the Chinese market through investments in multinational corporations. The firm’s cautious approach likely reflects concerns about the regulatory environment, intellectual property protection, and the increasing geopolitical tensions between the US and China. However, the situation remains dynamic, and Mithril’s China strategy could evolve in response to changing circumstances. The allure of the Chinese market is undeniable, and Mithril, like other venture capital firms, will continue to evaluate the opportunities and risks associated with investing in this dynamic and complex market. Further analysis of their future investments and public statements will be necessary to fully understand their approach to China.