Owner Financing in Texas: A Comprehensive Guide

Owner financing, also known as seller financing, is a real estate transaction where the seller of the property also acts as the lender. Instead of obtaining a mortgage from a traditional bank or credit union, the buyer makes payments directly to the seller according to an agreed-upon contract. This can be a viable option for buyers who may not qualify for conventional financing due to credit issues, lack of down payment, or self-employment income challenges. It can also be an attractive option for sellers looking to potentially earn a higher return on their investment. This comprehensive guide will explore the intricacies of owner financing in Texas, covering its advantages and disadvantages, legal considerations, and practical steps involved.

Understanding the Basics of Owner Financing

In a typical owner financing arrangement, the seller agrees to carry a loan for the buyer, essentially becoming the bank. The buyer makes regular payments, including principal and interest, as outlined in the promissory note. The property acts as collateral for the loan, meaning the seller can foreclose on the property if the buyer defaults on the payments. The specific terms of the agreement, such as the interest rate, down payment, loan term, and payment schedule, are negotiated between the buyer and seller.

Types of Owner Financing in Texas

Several types of owner financing structures exist in Texas, each with its own nuances:

Deed of Trust

This is the most common type of owner financing in Texas. A Deed of Trust involves three parties: the borrower (buyer), the lender (seller), and the trustee. The buyer conveys the property to the trustee, who holds it in trust for the lender until the loan is fully repaid. This structure simplifies the foreclosure process for the seller if the buyer defaults.

Contract for Deed (also known as a Land Contract)

In a Contract for Deed, the seller retains legal title to the property until the buyer fulfills all the terms of the contract, including making all payments. Once the buyer completes the payments, the seller transfers the deed to the buyer. While once common, Contracts for Deed are now less prevalent due to legal complexities and potential risks for the buyer.

Wraparound Mortgage

A wraparound mortgage involves the seller keeping their existing mortgage on the property and creating a new, “wrapped” mortgage with the buyer. The buyer’s payments to the seller cover the seller’s existing mortgage payments as well as the additional amount owed to the seller. This can be complex and requires careful drafting of the agreement.

Advantages of Owner Financing for Buyers

Owner financing can offer several benefits for buyers:

Easier Qualification

Buyers who struggle to qualify for traditional mortgages due to credit problems, insufficient income documentation, or a low down payment may find owner financing more accessible. Sellers may have more flexible lending criteria than banks.

Faster Closing

Owner financing transactions can often close faster than traditional real estate purchases because they involve less paperwork and fewer third-party approvals.

Flexible Terms

Buyers and sellers can negotiate the terms of the financing, including the interest rate, down payment, and loan term, which can be tailored to their specific needs.

Advantages of Owner Financing for Sellers

Owner financing can also be advantageous for sellers:

Potential for Higher Return

Sellers can potentially earn a higher return on their investment by charging a competitive interest rate on the loan.

Tax Benefits

In some cases, sellers may be able to defer capital gains taxes by spreading out the payments received over time. Consult with a tax professional for specific advice.

Attracting More Buyers

Offering owner financing can make the property more attractive to a wider range of buyers, potentially leading to a quicker sale.

Disadvantages of Owner Financing for Buyers

While owner financing offers several advantages, buyers should also be aware of the potential drawbacks:

Higher Interest Rates

Sellers may charge higher interest rates than banks to compensate for the increased risk of lending.

Shorter Loan Terms

Owner financing agreements may have shorter loan terms than traditional mortgages, requiring buyers to refinance or pay off the remaining balance sooner.

Potential for Disputes

Because the agreement is between two individuals, there is a greater potential for disputes to arise, especially if the contract is not clearly written and understood by both parties.

Disadvantages of Owner Financing for Sellers

Sellers should also consider the potential disadvantages of owner financing:

Risk of Default

There is always a risk that the buyer may default on the loan, requiring the seller to foreclose on the property.

Administrative Burden

Sellers will need to manage the loan payments, track the balance, and potentially handle the foreclosure process if necessary.

Legal Complexities

Owner financing transactions can be complex, and sellers should seek legal advice to ensure the agreement is properly structured and enforceable.

Legal Considerations for Owner Financing in Texas

Owner financing transactions in Texas are subject to various legal requirements. It’s crucial for both buyers and sellers to understand these regulations and seek professional guidance to ensure a smooth and legally sound transaction.

Texas Property Code

The Texas Property Code governs many aspects of real estate transactions, including owner financing. It outlines requirements for contracts, deeds, and foreclosure procedures.

Usury Laws

Texas has usury laws that limit the amount of interest a lender can charge. Sellers must ensure that the interest rate they charge does not exceed these limits.

Foreclosure Process

If the buyer defaults on the loan, the seller must follow the legal foreclosure process in Texas, which involves providing notice to the buyer and conducting a foreclosure sale.

SAFE Act

The Secure and Fair Enforcement for Mortgage Licensing Act (SAFE Act) requires individuals who engage in certain mortgage-related activities, including owner financing in some circumstances, to be licensed. Sellers should consult with a legal professional to determine if they need to obtain a license.

Steps Involved in an Owner Financing Transaction

The following steps are generally involved in an owner financing transaction in Texas:

Negotiation

The buyer and seller negotiate the terms of the financing, including the purchase price, down payment, interest rate, loan term, and payment schedule.

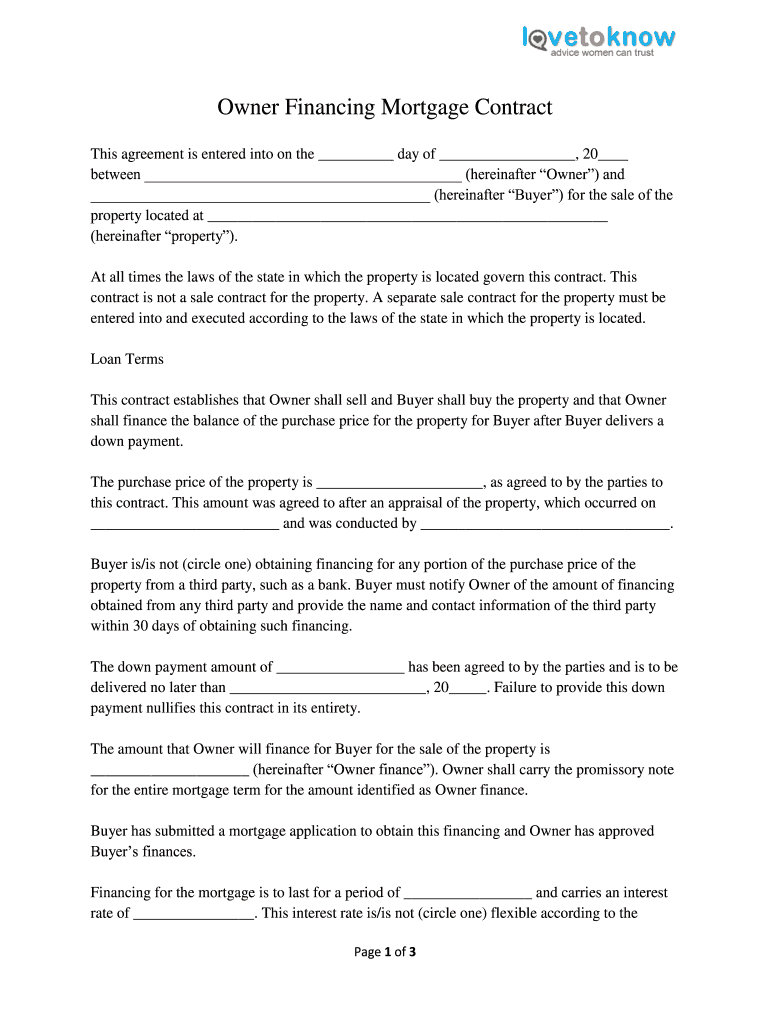

Contract Preparation

A legally binding contract, typically a Deed of Trust, is drafted outlining the terms of the agreement. It is highly recommended that both parties engage legal counsel.

Due Diligence

The buyer should conduct due diligence on the property, including obtaining a title search, appraisal, and inspection.

Closing

The closing process involves signing all necessary documents, including the Deed of Trust and promissory note, and transferring ownership of the property to the buyer.

Loan Servicing

After the closing, the seller or a third-party loan servicer will manage the loan payments, track the balance, and send statements to the buyer.

Tips for Buyers and Sellers

Here are some essential tips for buyers and sellers involved in owner financing transactions:

Seek Legal Advice

Both buyers and sellers should consult with a real estate attorney to ensure the agreement is legally sound and protects their interests.

Get Everything in Writing

All terms of the agreement should be clearly documented in a written contract.

Conduct Due Diligence

Buyers should conduct thorough due diligence on the property, and sellers should carefully assess the buyer’s creditworthiness.

Consider Loan Servicing

Using a third-party loan servicer can simplify the loan administration process for both buyers and sellers.

Understand the Foreclosure Process

Both buyers and sellers should understand the legal foreclosure process in Texas in case of default.

Conclusion

Owner financing can be a valuable tool for both buyers and sellers in Texas real estate transactions. However, it is essential to understand the legal requirements, potential risks, and practical steps involved. By seeking professional guidance and carefully considering all aspects of the transaction, buyers and sellers can create a mutually beneficial agreement. This information is for educational purposes only and does not constitute legal advice. Always consult with a qualified legal professional for advice tailored to your specific situation.