Park Model Financing: A Comprehensive Guide

Park model homes, also known as recreational park trailers, offer a unique blend of affordability and comfort, making them an increasingly popular choice for those seeking a vacation home, a downsized residence, or a temporary housing solution. However, navigating the financing landscape for these unique dwellings can be complex. This comprehensive guide will delve into the intricacies of park model financing, providing you with the knowledge you need to make informed decisions.

Understanding Park Models

Before diving into financing, it’s crucial to understand what park models are and how they differ from other types of housing. Park models are essentially recreational vehicles (RVs) designed to look and feel more like traditional homes. They typically range from 400 to 500 square feet and are built to meet ANSI A119.5 standards, which classify them as recreational vehicles, not manufactured homes. This distinction is critical, as it significantly impacts financing options.

Why Financing a Park Model Can Be Challenging

The classification of park models as RVs, despite their residential appearance, creates a unique challenge in the financing world. Traditional mortgage lenders often shy away from park models due to their RV status, leading to a more limited pool of financing options. Here’s why:

RV Classification: As mentioned, their RV classification often excludes them from traditional mortgage products.

Exploring Your Financing Options

Despite the challenges, financing a park model is possible. Here are the most common avenues to explore:

RV Loans

Since park models are technically RVs, RV loans are the most common financing option. These loans are typically offered by banks, credit unions, and specialized RV lenders.

Pros: Readily available, familiar process for those who have financed RVs before.

Chattel Loans

Chattel loans are used for personal property, and since park models are often classified as personal property, these loans can be a viable option.

Pros: Can be used for items not permanently attached to land.

Personal Loans

Unsecured or secured personal loans can be used to finance a park model, especially if the loan amount is relatively small.

Pros: Can be an option if you have good credit.

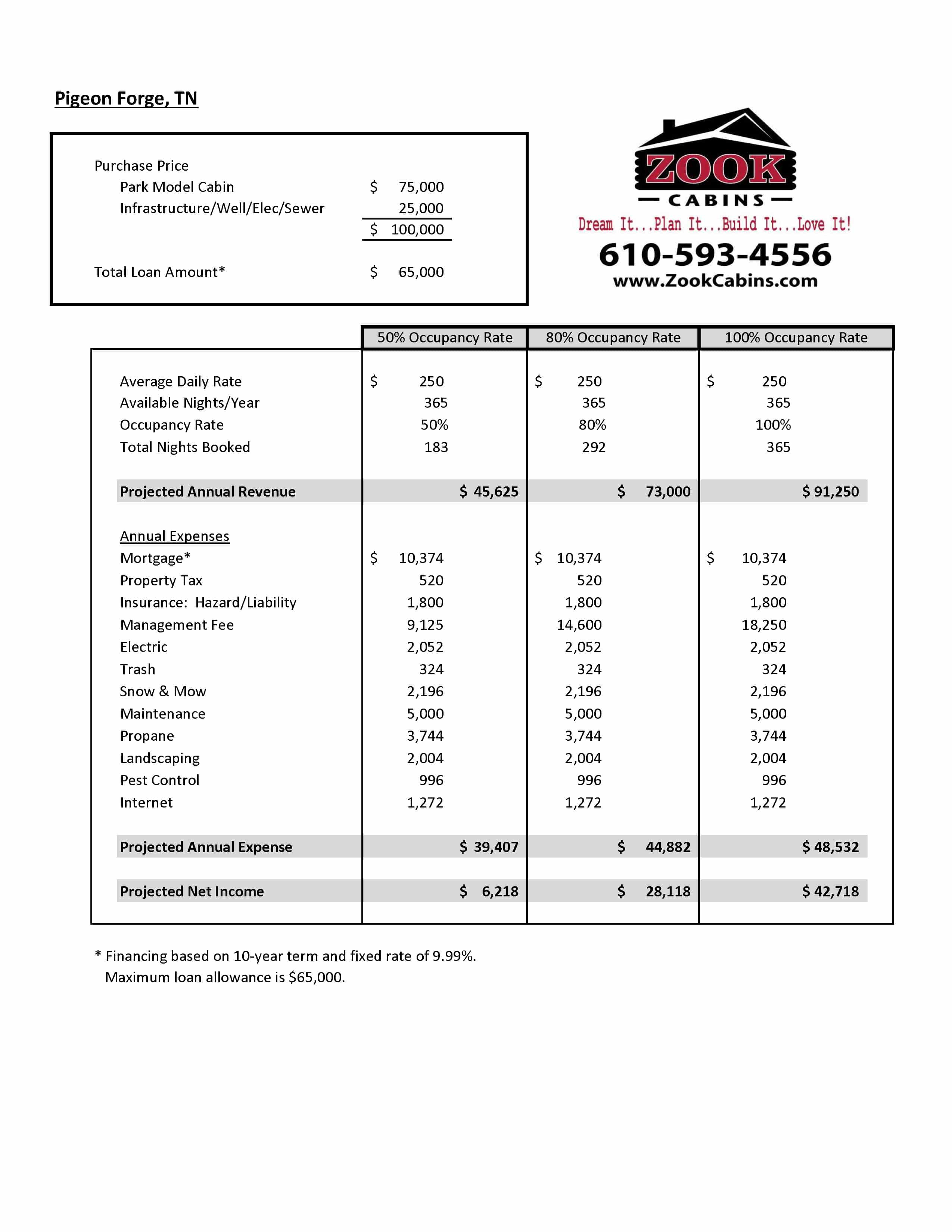

Manufacturer Financing

Some park model manufacturers offer financing options directly to buyers. These programs can be convenient, but it’s essential to compare their terms and interest rates with other lenders.

Pros: Convenient, may offer special promotions.

Home Equity Loans or Lines of Credit (HELOCs)

If you own a home with sufficient equity, you could use a home equity loan or HELOC to finance your park model purchase.

Pros: Lower interest rates than RV or chattel loans.

Cash Purchase

The most straightforward option is to purchase the park model outright with cash. This eliminates the need for financing altogether.

Pros: No interest payments, no loan applications.

Factors Affecting Park Model Financing

Several factors influence your ability to secure financing for a park model and the terms you receive:

Credit Score

Your credit score is a crucial factor. A higher credit score will improve your chances of approval and qualify you for lower interest rates.

Down Payment

A larger down payment demonstrates financial stability and reduces the lender’s risk, which can lead to better loan terms. For park model financing, expect down payment requirements similar to RV loans, often 20% or more.

Loan Term

Loan terms for park models are typically shorter than traditional mortgages, often ranging from 5 to 15 years. Shorter terms mean higher monthly payments but lower overall interest paid.

Park or Lot Lease

The terms of your park or lot lease can impact financing. Lenders may prefer long-term leases or ownership of the lot.

Park Model Location

The location of the park model can also be a factor. Lenders may be more willing to finance in established, well-maintained communities.

Age and Condition of the Park Model

Newer park models are generally easier to finance than older models. The condition of the park model will also be assessed.

Tips for Securing Park Model Financing

Navigating the world of park model financing requires careful planning and preparation. Here are some tips to increase your chances of success:

Improve Your Credit Score: Check your credit report and take steps to improve your score before applying for financing.

Understanding the Fine Print

Before signing any loan agreement, carefully review all the terms and conditions, including:

Interest Rate: Understand the interest rate and whether it is fixed or variable.

The Future of Park Model Financing

As park models become increasingly popular, the financing landscape may evolve. More lenders may begin offering specialized financing options for these unique dwellings. Industry associations and advocacy groups are also working to educate lenders and promote greater access to financing for park model buyers.

Conclusion

Financing a park model can be a complex process, but it’s not impossible. By understanding the unique challenges and exploring the available options, you can find a financing solution that fits your needs and budget. Careful planning, a good credit score, and a thorough understanding of the terms and conditions of your loan are essential for a successful park model purchase. Remember to consult with financial professionals to get personalized advice based on your individual circumstances.